Why the business case is critical to driving wholesale supply chain technology investments

The wholesale industry hinges on efficiency, and any hiccup in the supply chain risks damaging customer relationships and the bottom line. Given wholesale’s typically razor-thin margins, the price of inefficiency can be incredibly steep. Struggling to manage the impacts of shortages, delays, and inflation-fuelled cost increases, overburdened wholesalers need a way forward that involves thriving, not just surviving.

Meet TrustedBrands, our hypothetical wholesaler

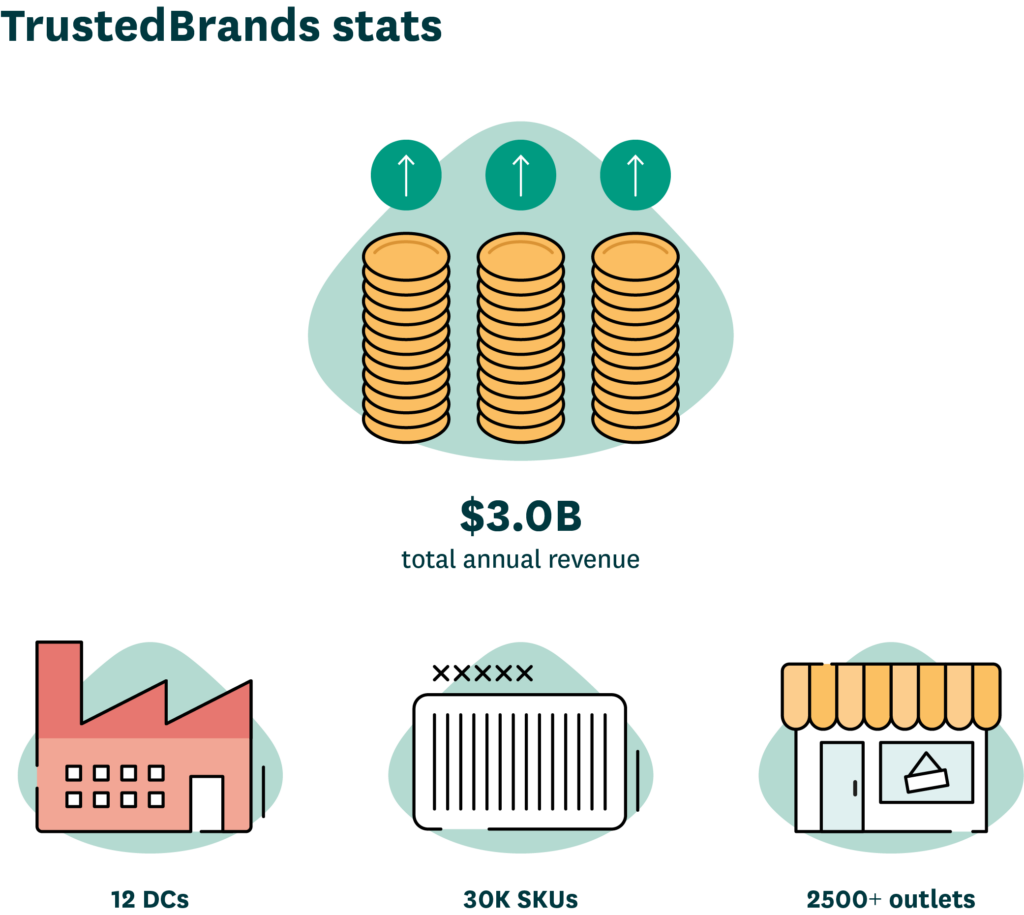

To illustrate the process of building a business case, we have created a hypothetical business, TrustedBrands. TrustedBrands is a US-based wholesaler with a grocery focus – fresh and shelf-stable – but also deals significantly in consumer goods categories, including household, cleaning, pet, and health and beauty products. TrustedBrands’ annual revenue is $3 billion. They manage more than 30,000 SKUs from their 12 distribution centers, serving over 2,500 outlets.

Dale is TrustedBrands’ VP of Supply Chain. He has recognized the need to update TrustedBrands’ processes to control and reduce rising costs and streamline their collaboration with retailers and manufacturers. He decides to set about building a case for technology investment. Nicole is the company’s National Sales Director. She supports Dale’s plan because she knows an improved supply chain will lead to better availability and increased revenue.

Dale and Nicole both know that, with margins being tight and leaving no room for mistakes, they cannot afford to move forward on any investment without a solid business case that accomplishes three essentials:

- Build an honest and comprehensive assessment of TrustedBrands’ current state to understand the most significant challenges and impact areas.

- Translate their assessment into key improvements and develop realistic, specific, measurable goals based on research and benchmarking.

- Collaborate with preferred vendors who use experience and real-world data to calculate potential financial benefits and KPIs for measuring success in the future.

Dale and Nicole weigh in on TrustedBrands’ current state

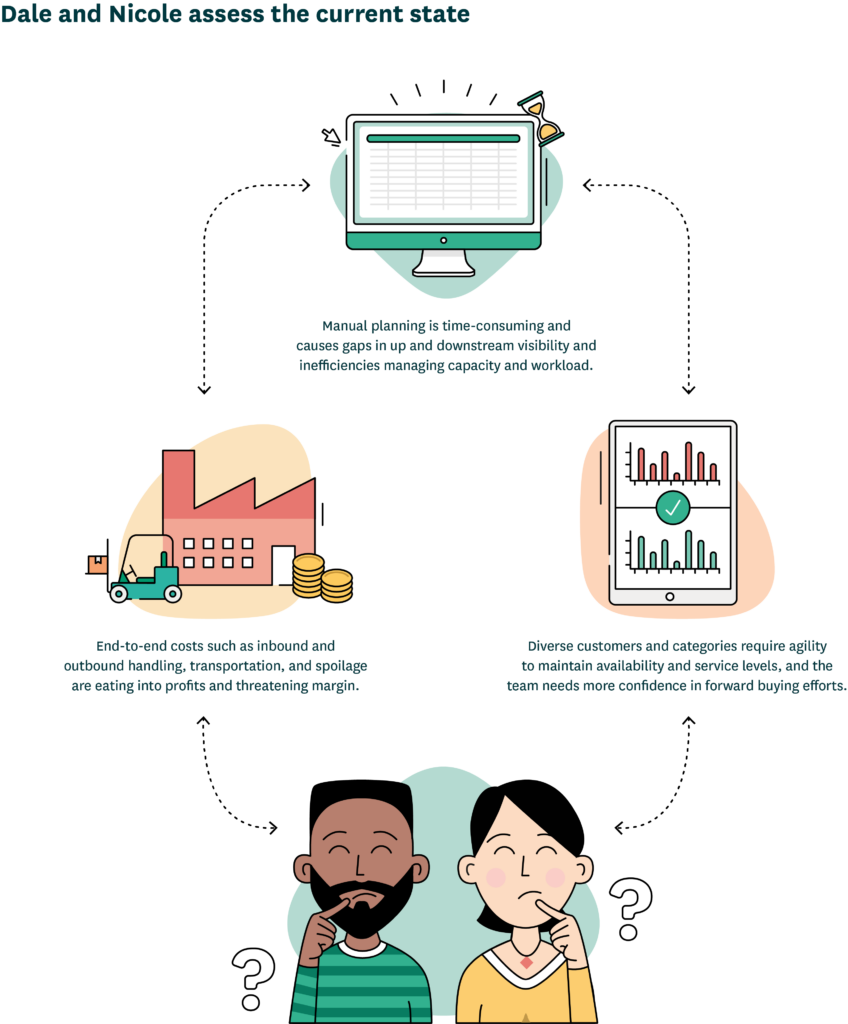

The first step to creating a compelling business case is to understand the business’s current state. Dale and Nicole need a transparent and honest assessment of where they are today to focus on improvement areas that will result in the most significant impacts for the business.

End-to-end costs

Margins, which are thin in the best times, can be significantly threatened during supply chain disruption and economic uncertainty. TrustedBrands is aware that operational efficiency is critical to fighting margin erosion. Competition is stiff, and there is no room for error.

Among Dale’s most significant cost areas – and most impactful on TrustedBrands’ ability to operate – are handling and transportation. Wholesalers live or die by their ability to move diverse product sets seamlessly from suppliers to retailers while negotiating the best prices. However, those prices depend on efficiently getting the products from place to place and managing them during the process. Truck building for maximum economy and managing capacity in DCs for efficient picking and packing are two essential areas that can help reduce costs and fight margin erosion.

Spoilage has become more of an issue in fresh categories. Dale can’t compromise availability, but his challenge is maintaining it without holding excess stock. He doesn’t have the agility that grocers have, where they can push products into stores. He needs better visibility into upcoming demand cycles to proactively forecast and work with fresh suppliers.

Manual planning

TrustedBrands’ legacy system requires quite a bit of manual planning, resulting in challenges when planning on a channel/granular level. They need the ability to plan for individual customers’ unique situations, such as service levels and trade agreements and availability targets – which is especially important for Tier 1 customers. Bolt-on systems are not ideal for handling complex tasks like investment buying, truck building, and fresh management – they are not agile or adaptable enough to respond across multiple customer types and strategies.

A lack of visibility up- and downstream prevents efficient end-to-end collaboration. For example, Nicole’s team lacks complete visibility into customers’ promotion plans and struggles to proactively ensure they are prepared to meet those needs. The team frequently must play catch-up to fill orders and meet service-level requirements. Dale’s team also struggles with visibility and finds it challenging to manage suppliers when demand shifts or special circumstances arise.

TrustedBrands’ diverse customer base and needs strain their capacity limits. There are only so many tasks that the teams can execute in a day, and workloads are ever-increasing. Purchasing and planning costs are rising, and complexity increases year-over-year. Dale and Nicole’s teams need a more streamlined and efficient capacity and time management approach.

Sales & availability

Disruptions in global and local supply chains lead to availability issues, resulting in low service levels. Dale is concerned about their ability to pivot quickly when problems arise to prevent availability drops while not raising holding costs.

Nicole knows that their position in the market is entirely dependent on maintaining service levels. She is painfully aware that her retail customers are fickle and under their own pressures, and if her team can’t provide products, they will go somewhere else.

To make things more challenging, Nicole and her team must be able to keep up with a diverse set of retailers with unique needs, agreements, and availability requirements and move quickly with shifts in forecasts and orders across multiple banners, thousands of stores, and diverse channels.

Nicole would like to engage in more forward (investment) purchasing but knows it’s a tricky business, especially for perishables. She worries that holding costs could erase the initial price advantage without accurate forecasting. Neither Nicole nor Dale is confident in the agility of their manual systems to forecast accurately enough to justify the risks of expanding the practice.

Building the case: TrustedBrands’ supply chain needs

Dale and Nicole use their current state assessment to identify specific challenge areas and establish realistic improvement goals. Dale breaks his focus into two primary areas: purchasing and distribution. Nicole contributes sales & availability as a third focus area.

Purchasing

Dale starts with purchasing-related cost drivers and identifies three critical areas of improvement. Purchasing accounts for $2.1B, 70% of TrustedBrands’ revenue, and Dale wants to find ways to bring that number down. He also calculates that inbound handling is $30.0M and purchasing labor accounts for $420k annually. He is confident that these costs can be cut by improving efficiency in the business.

Dale uses industry benchmarks and research to create specific, measurable goals for improvements in these areas.

Through better forecasting and collaboration with upstream suppliers via increased visibility and more accurate ordering, Dale estimates that he can reduce their purchasing costs by up to 0.5%, which would provide significant savings considering the amount in question.

He is also confident that improved agility and accuracy from automated forecasting will help Nicole better plan for and engage in forward purchasing.

Handling and manual planning are high on Dale’s list of costs to control. He believes better visibility with suppliers will help optimize order volumes and frequency to maximize truckloads. He estimates that using an automated system to manage capacity and workforce needs will reduce inbound handling by 8-11% and reduce costs from manual planning by up to 10%.

Distribution

Dale then turns his attention from inbound to outbound costs and identifies three distribution-related areas for improvement. First, Dale wants to drive reductions in inventory value, which stands at $70.0M, and carrying costs, which are $4.2M. Spoilage amounts to $30.0M annually, which Dales knows is a financial and environmental issue. Outbound handling and transportation stand at $30.0M each.

Once again, Dale creates realistic, specific, and measurable goals to address these issues.

Dale wants to leverage an automated system to eliminate error-prone and time-consuming spreadsheets to balance inventory and availability better. He knows that an agile system can react quickly to demand shifts and potential supply bottlenecks, ensuring that he is not holding excess inventory out of fear of service level issues – which is especially critical for seasonal and slow-moving products. He estimates that TrustedBrands will be able to reduce their overall inventory value by 15-20% and carrying costs similarly, up to 20%.

Waste in fresh categories is an issue for everyone, but TrustedBrands has unique challenges as a wholesaler because they are a middleman between the suppliers and the shelf. Dale wants to leverage automation and speed to improve forecasting and push short-shelf life products through from end to end. He estimates that new technology will enable TrustedBrands to reduce spoilage by 18-20%.

Like inbound, Dale is sharply focused on handling costs and transportation. He estimates that increased forecast visibility with retail customers will optimize orders (especially for promotion campaigns) and maximize picking and truckloads, resulting in an outbound transportation cost reduction of up to 10%. Further, using a modern system to manage capacity and workforce needs is estimated to reduce outbound handling by 8-11%.

Sales & availability

As National Sales Director, Nicole’s primary focus is maintaining service levels for TrustedBrands’ retail customers to stay competitive and protect their already slim margins. Availability holds steady at 95%, and TrustedBrands’ margin is currently $300.0M. Nicole’s priority is to find a way to push availability higher and increase their margin. She also wants to reduce chargebacks and penalties, which account for $15.0M annually. Further, she is concerned that overly manual planning processes cost $490K annually and that planners could spend that time on tasks that add more value to customers.

Like Dale, Nicole uses research and benchmarking to create measurable goals for improvement. Working with Dale on the estimations and goals, they determine that modern technology would improve their availability by approximately 3%, leading to proportionate revenue and margin uplifts.

Nicole also appreciates that money saved is money earned and that optimizing their supply chain technology would help TrustedBrands save up to 40% per year on chargebacks and penalties.

Automation increases efficiency and helps mitigate labor shortages and constraints on capacity due to service level requirements. Dale estimates that an automated system will reduce manual planning by up to 25%.

TrustedBrands’ business case for investing in wholesale supply chain technology

With their improvement goals in place, Dale and Nicole need to use their estimations to build a set of potential financial benefits for their proposed investment. Working closely with preferred vendors with proven success in similar cases and breadth of industry expertise, Dale and Nicole are confident in their benefit estimations and have compelling support for technology investment.

Dale estimates that TrustedBrands can reduce purchasing by $13.5M. He also estimates a $3.0M savings in inbound handling and a $105,000 savings in time spent on manual purchasing processes. TrustedBrands’ potential purchasing savings total $16.6M. Additionally, he estimates that the improvements will result in a $3.0M savings in forward buying.

Dale’s potential distribution benefits include a $798,000 reduction in inventory carrying, a $3.0M saving in outbound handling, and an outbound transportation savings of $3.0M. He also estimates a $6.0M savings in spoilage due to improved forecasting. The potential distribution benefits for TrustedBrands total $12.8M.

On Nicole’s side of the business, potential sales & availability benefits include a $27.0M revenue uplift. She also estimates a reduction in chargebacks & penalties of $9.0M. The result is a combined increase in revenue of $36.0M, leading to a margin uplift of $3.6M.

Together, Dale and Nicole estimate that their proposed technology investment could provide TrustedBrands with a total annual benefit of $33.0M and an immediate one-time benefit of $13.3M from an initial reduction in inventory.

Beyond the financial benefits, Dale and Nicole expect to see intangible benefits that are not easily quantified but still vital to the business. These “soft” benefits include:

- Improved up- and downstream collaboration. Increasing efficiency and automating formerly time-consuming and error-prone processes will boost TrustedBrands’ collaborative relationships on both sides of the business. The speed and agility from automating processes and the insights and visibility from a modern machine learning-enabled system will improve forecasting and supplier negotiations and help the sales teams take service for retail customers to new levels.

- Reduced stress from team members across functions. Manual processes, such as working in numerous spreadsheets, are time-consuming and prone to errors. Lack of end-to-end visibility and siloed teams result in costly, stressful capacity and workforce issues. Modern, automated tools enable team members to focus more on service than spreadsheets and give them the accuracy to confidently plan their workforce to meet the needs of receiving and distribution efficiently. Further, reducing stress helps mitigate turnover, reducing the costly and time-consuming process of recruiting and training new employees.

The Key Takeaway: Using Real Data Will Drive the Most Reliable Results

The benefits of investing in wholesale supply chain technology are numerous, as evidenced by TrustedBrands’ potential savings and revenue uplifts. Our hypothetical case demonstrates the importance of building a solid business case for technology investment, focusing on three essential aspects:

- Assessing the current state of the business.

- Setting realistic and measurable improvement goals.

- Leveraging vendors’ expertise to estimate realistic financial benefits.

When building a compelling business case for technology investment, it is crucial to use researched data and work closely with preferred vendors to develop the most realistic benefit estimations possible. This approach ensures the investment is well-founded and more likely to deliver the desired results. By leveraging data and industry expertise, companies can make informed decisions that drive supply chain efficiency and overall business success.

In today’s competitive wholesale landscape, investing in supply chain technology is no longer a luxury but a necessity. By following the proper process, focusing on clear goals, and developing measurable KPIs, businesses can confidently build a strong case for technology investment and reap the rewards of a more efficient and profitable supply chain. Embracing data-driven decision-making and collaborating with experienced vendors will ensure that the investment yields the best possible results, ultimately leading to a thriving wholesale business.